On 12th May 2020, India’s honourable PM addressed the nation and announced an economic stimulus package of INR 20 lakh crore, amounting to ~10% of the country’s GDP. The primary aim of the package was to make India self-reliant and self-dependant in terms of production and services.

This is how India compares to other countries in terms of economic packages as % of GDP.

However, this 20 lakh crore package already includes the reliefs which have been announced earlier. These include-

- INR 1.7 lakh crore package announced by Finance Minister Nirmala Sitharaman, on March 26.

- INR 5.2 lakh crore liquidity measures announced by the RBI Governor Shaktikanta Das.

In response to the announcement by the Prime Minister, the Sensex rallied 1,474 points to settle at 637 points higher (+2.03%), while the Nifty rallied 187 points to close at 9,384 points (+2.03%).

This leaves out a balance of ~13 lakh crores, of which a portion was laid out by the Finance Minister on 13th May 2020, at 4:00 PM.

The measures to be announced in the day’s tranche were divided into 14 different measures; 6 for MSMEs, 2 for EPF, 2 for NBFCs and MFIs, 1 for discoms, 1 for contractors, 1 for real estate sector and 3 tax measures.

MSMEs-

- For Standard MSMEs, collateral-free automatic loans worth INR 3 lakh crore to be provided, with a tenure of 4 years and 100 per cent guarantee. No principal repayment for 12 months.

- INR 20,000 crores to be infused through subordinate debt for stressed MSMEs having equity problems. All NPAs or stressed MSMEs are eligible for the scheme. The government to provide INR 4,000 crore to CGTMSE who will provide a partial guarantee to the banks, who will then give benefit to stressed MSMEs.

- The Funds of Fund to be set up with a corpus of INR 10,000 crore and will infuse INR 50,000 crore in form of equity. The Fund of Funds will be operated through a Mother Fund and few daughter funds.

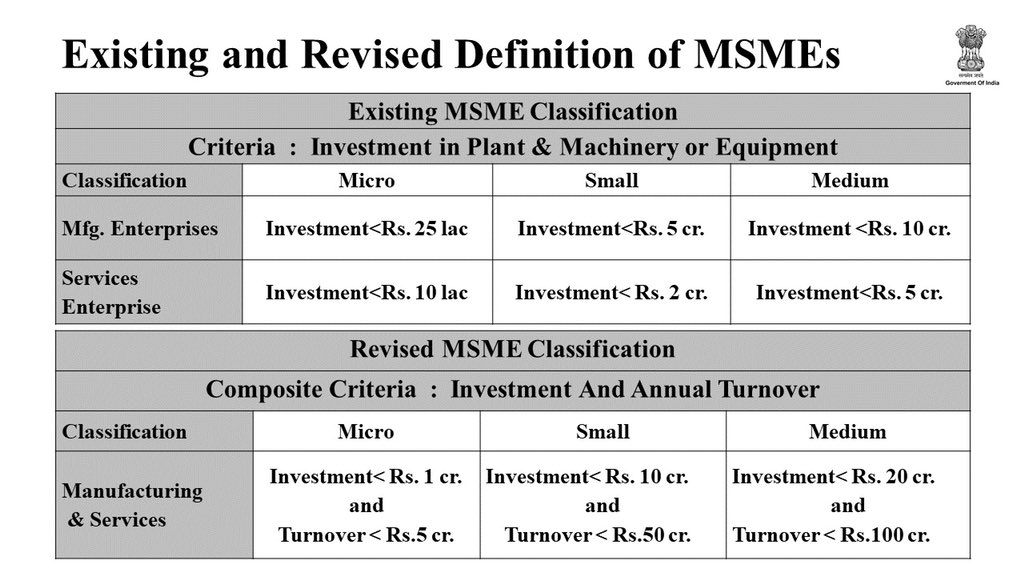

- Reclassification of MSMEs in their benefit. Investment limit which defined MSMEs have been revised upwards.

Source: PIB India. - Global tenders in government procurement to be disallowed for up to INR 200 crore or less. This will provide a better chance for MSMEs to compete for these projects.

- Since trade fairs and exhibitions will be difficult in the current scenario, the government to provide e-market facilities. GoI and CPMEs pending receivables to be cleared within 45 days.

EPF-

- EPF relief for all establishments with INR 2,500 crore liquidity support. The GoI to provide the employer’s and employee’s 12% contribution to the fund. Extending support for another three months from March-May 20 to June-August 2020.

- Statutory PF contribution decreased from 12% to 10%, to increase the in-hand salary. For state PSUs – the employers will continue to pay 12 per cent, employees will get an option to pay 10 per cent for the next three months.

NBFCs, HFCs and MFIs-

- Launch of INR 30,000 crore special liquidity scheme where the GoI will buy Investment grade paper of NBFCs, HFCs and MFIs. These securities will be fully guaranteed by GoI.

- INR 45,000 crore liquidity infusion through a partial guarantee scheme. First 20% loss will be borne by the guarantor i.e. the GoI.

Discoms (Power Distribution Companies)-

- A one-time emergency liquidity infusion of INR 90,000 crore via PFC and REC. This will be a state-issued guarantee and rebate will be provided to those discoms that pass the benefit to end-customer.

Contractors-

- All the GoI agencies to give an extension to contractors of 3-6 months without any additional costs. To facilitate greater liquidity, government agencies will partially release bank guarantees to the extent of the completed contract so that cash flow improves.

Real estate Sector-

- The Urban Development Ministry shall issue advisories to states and UTs to treat the COVID-19 period as an ‘Act of God’ and thus allow force majeure. This will essentially ensure that fresh project registration certificates can be issued and, registration and completion date can be extended suo moto for up to six months for projects registered on or after March 25, 2020.

Taxation-

- Reduce TDS and TCS rates by 25 per cent. This is applicable on all payments and is applicable from 14th May 2020 to 31st March 2021. It is estimated to increase liquidity in the hands of the public by INR 50,000 crores.

- All pending refunds of charitable trusts, non-profit businesses, cooperatives and small partnerships to be issued immediately.

- Due date of all I-T returns for FY19-20 from July 31 2020, and October 31 2020, extended till November 31, 2020. Tax audits extended from September 30 2020, till October 31, 2020. Date of assessments getting barred as of September 2020 is extended till December 2020. Those getting barred on March 31 2021, are being extended till September 31, 2021. Vivad se Vishwas scheme is being extended till December 31 2020, without any additional amount.

These were the crux of the measures taken by the FM today. Though these measures will certainly provide a liquidity boost, they are primarily in the nature of deferment and not actual monetary relief. Hence while we can expect increased liquidity for the economy in coming months, it might struggle to shrug off the burden in later years to come.

— Shubham Singhal